If you’ve been hustling to get more leads, spending hours on content, or wondering why growth feels like a grind, this post is for you.

There’s one powerful number that can change how you market, sell, and scale:

Customer Lifetime Value KPI (CLV KPI)

Most small businesses ignore it. But those who understand it? They scale smarter, with less stress and more profit.

Let’s break it down.

What Is the Customer Lifetime Value KPI?

The Customer Lifetime Value KPI tells you the total revenue you expect to earn from a single client over the course of your relationship.

It’s one of the most crucial business metrics for long-term sustainability.

The formula is simple:

CLV = Average Purchase Value × Purchase Frequency × Customer Lifespan

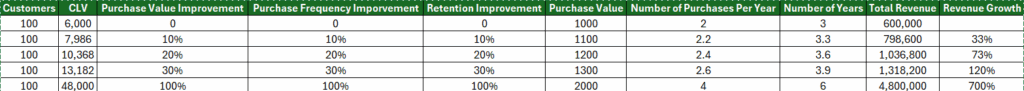

For example, if a client spends $1,000 per transaction, buys twice a year, and stays with you for 3 years:

$1,000 × 2 × 3 = $6,000 CLV

While you can calculate a high-level CLV value with this simple formula, technology today allows you to have a very precise number.

With a good CRM in place that tracks all transactions, you can not only calculate the exact average CLV, but you can also analyze CLV across customer segments and even compare the number for your top 20% clients vs. the bottom 20% clients, thus making it easy to “fire” the bottom 20% and focus on the top.

Why Is the Customer Lifetime Value KPI So Important?

Because it changes how you make decisions.

Yes. That straightforward.

CLV tells you a story and…

When you know your CLV & the story:

- You spend smarter on marketing, because you know what a client is really worth.

- You prioritize your top clients, not just the loudest or newest ones.

- You optimize for retention and repeat business, not one-time sales.

- You shift from “get more leads” to “maximize the value of each relationship.”

What Happens When You Don’t Track CLV?

Now, let’s explore the other side of the coin.

This story might be more familiar to you. Because chances are, you are operating from this reality.

The reality of not knowing your CLV KPI and:

- Under-investing in growth out of fear.

- Wasting time on low-value clients.

- Burning out chasing short-term wins.

- Leaving massive revenue on the table.

The worst part is that these are all blind spots when you don’t know your CLV.

Yes, you don’t even realize you are missing so many opportunities and wasting so much time and effort.

So, go calculate your CLV now. Even if it’s a ballpark number.

And, then, focus on improving it.

3 Ways to Improve Your Customer Lifetime Value KPI

Want to grow your business without growing your workload?

Improve your CLV KPI by focusing on these three levers:

1. Increase Purchase Value

Offer premium packages, upsells, or bundles.

If the average customer transaction is $1,000 now, maybe you can add a bonus that makes it $1,100.

2. Increase Purchase Frequency

Encourage clients to buy more often (e.g., monthly check-ins, new services).

The second lever is the frequency. If customers buy twice a year, maybe you can update the journey and increase the frequency to three times.

3. Increase Retention

The last component is to keep clients longer by delivering consistent value and building strong relationships.

Think about it.

You have already acquired these clients and are delivering value to them.

They know, like, and trust you with their money.

How can you extend the relationship?

Even a small lift in each of these three levers can multiply your CLV and your bottom line.

Just look at the numbers. 10% improvement in each lever increases your overall revenue by 33% while still working with the same number of clients.

What happens if you double all three levers?

Your total revenue will be 7X-ed with the same number of customers!

Yes, there’s magic in this KPI and the story these numbers show.

CLV KPI as a Mindset Shift

Tracking the customer lifetime value KPI changes how you think about business:

- From transactional to transformational

- From volume to value

- From “I need more leads” to “I need better relationships”

When you understand how much your best clients are worth, stop chasing and start building.

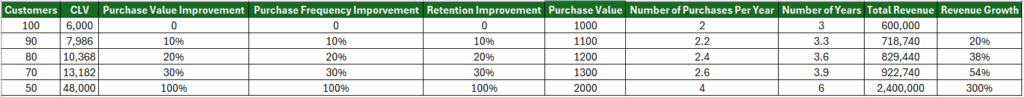

Going back to the numbers.

Let’s say you check your CLV across segments and your top vs. bottom clients and decide to “fire” your bottom 10 clients. So, you are left with 90 instead of 100 clients, but each lever grows by 10%. The result? Your total revenue has increased by 20%.

Yes! You are working with fewer clients, saving you time and effort, and earning more.

And look at the last row. If you double each of the levers while reducing your client base by 50%, yes, you remove half of your customer base, but your revenue will still triple!

How to Start Tracking CLV KPI in Your Business

You don’t need fancy tools. Start with:

- Your CRM or invoicing system

- A simple spreadsheet

- This formula: CLV = Avg. Sale × Purchase Frequency × Client Lifespan

Tag your top 20% of clients. Monitor their buying behavior. Build offers around them.

And yes, go deeper: factor in profit (not just revenue) for accurate CLV insights.

Why CLV KPI Is Better Than Vanity Metrics

Social media followers don’t pay your bills. These do:

- CLV per client

- Conversion rates

- Client retention

- Net profit per customer

Focus on what moves the needle, not what inflates your ego.

Yes, visibility is good. You don’t want to be the best-kept secret.

Yet, for small- and mid-sized businesses, visibility comes after the delivery and traction.

Make the Customer Lifetime Value KPI Your Growth Compass

Chances are that you don’t need more clients.

As long as you have a good client base, you actually need to understand the ones you already have.

Track your CLV. Optimize for it. Build a business that grows with you, not against you.

The customer lifetime value KPI is a metric and your most powerful business strategy.

Want to Win a $5,000 Business Clarity Accelerator?

We’re giving one lucky subscriber a FREE Thrive360 Business Clarity Accelerator: our 2-day strategic deep dive that helps you optimize key metrics like CLV and build a business that runs without you.

Subscribe to our newsletter, Thrive & Empower 360, for a chance to win!

Join Now Here

Inside, you’ll get:

- Weekly growth insights

- Systems strategies that scale

- Real business advice, no fluff

Know your numbers. Grow with purpose. Start by tracking your customer lifetime value KPI.